Dune Digest 030

RWA's special edition: BENJI, thBILL, DRIP, Ondo GM, Centrifuge SPXA, Aave Horizon, nTBILL, nCREDIT

Exclusive content

Download Content

Since we shipped the RWA Report 2025, the market has kept sprinting and September has seen —validating our four theses in real time.

Treasuries as the base layer

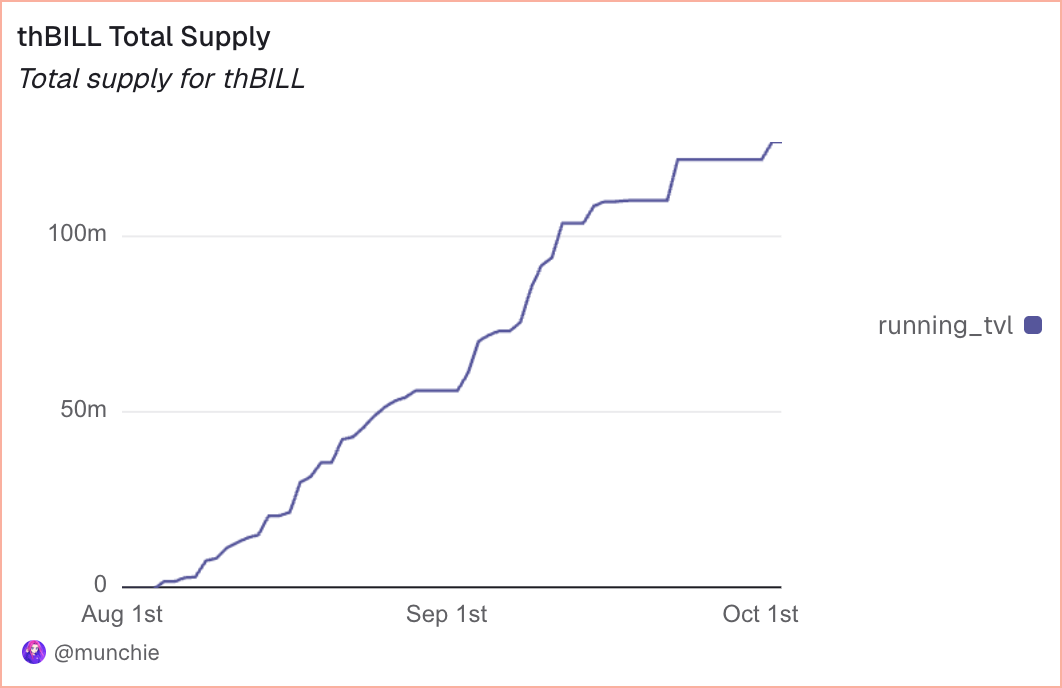

Treasuries as the base layer. The cash-like end keeps broadening its footprint: Franklin’s BENJI expanded to BNB Chain, while Theo Network’s thBILL (tokenized short-duration U.S. T-Bills) launched on Ethereum and Arbitrum and surpassed $100M TVL, with a starring role in Arbitrum’s DRIP (it became the #1 USD-eligible asset with $82M market size). Furthermore, Galaxy teased a multichain tokenized money market fund (Ethereum, Solana, Stellar) to unify institutional cash-equivalents. These expansions and new launches underscore a key point from the report: even as the opportunity set expands, high-quality, liquid treasuries remain the credibility and liquidity anchor, still highly appealing despite a growing menu of higher risk-return products.

Up the yield curve

Up the yield curve. With that foundation solid, capital continues to move up the yield curve. Grove deployed $50M into Anemoy’s Tokenized Apollo Diversified Credit Fund (ACRDX) on Plume × Centrifuge, bringing diversified credit onchain at launch scale. Maple crossed $4B AUM: syrupUSDC, which also expanded to Arbitrum via DRIP, accounts for $2.6B with ~$1.2B loans outstanding, while syrupUSDT ranks second with $636M (the $200M Plasma vault filled instantly). Equities are also sustaining the momentum: Ondo Global Markets surpassed $300M TVL with ETFs now ~61% of TVL, Galaxy tokenized GLXY on Solana (SEC-registered shares; holders tripled to 70+), and Centrifuge launched SPXA, the first licensed S&P 500® index fund token on Base (Wormhole expansion next).

DeFi composability is accelerating

The bridge from compliant assets to DeFi keeps strengthening: Aave’s Horizon RWA market is at $180M total size ($134M available, $45M borrows), with Superstate’s USCC ~$56M, RLUSD ~$54M, and Anemoy JTRSY ~$34M among leaders. Centrifuge deRWA expanded to Stellar with $20M into deJTRSY and deJAAA, and deJAAA crossed $1M+ DEX volume on Base. Theo Network's thBILL tokenized Treasury fund integrated with Pendle in September 2025, enabling users to trade future yields via Principal and Yield Tokens. All clear signs that RWAs are being recognized as valuable building blocks of the onchain economy.

Access is broadening

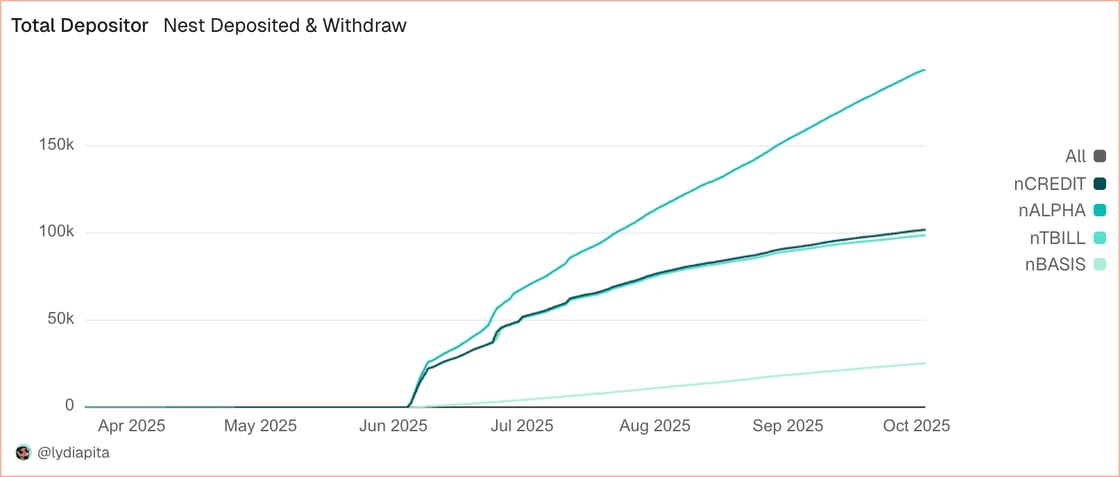

Higher-yield products, permissionless formats, deeper DeFi integration, and new asset categories are pulling in a wider user base. On Plume, Nest keeps compounding user scale: nTBILL and nCREDIT are around 100K holders each, and nALPHA is nearing 200K; nBASIS just went multichain expanding to Plasma, and opening USDT flows into Nest. Beyond treasuries and credit, new categories continue to open the tent: GAIB grew from $72M → $115M TVL (GPU-backed yield, plus a new USD1 on BNB Chain vault), and Spiko’s EUTBL surpassed 1,500 holders as non-usd money-market adoption widens.

Infrastructure matters, too.

Securitize expanded to Sei with Apollo’s ACRED as the first tokenized offering, while XRP Ledger’s MPT aims to streamline compliant RWA issuance and DeFi support.

Bottom line: the flywheel is spinning—quality base assets → higher-yield products → DeFi integration → broader access.

If you haven’t yet, grab the full report for the data, dashboards, and theses behind the trendlines:

Ready to bring your Blockchain to Dune?

Power your App with Dune data

Steam Dune data in your analytics environment

Want to join Dune?

Dune Datashare

Ready to get started?

Individuals + Small Teams

Enterprise